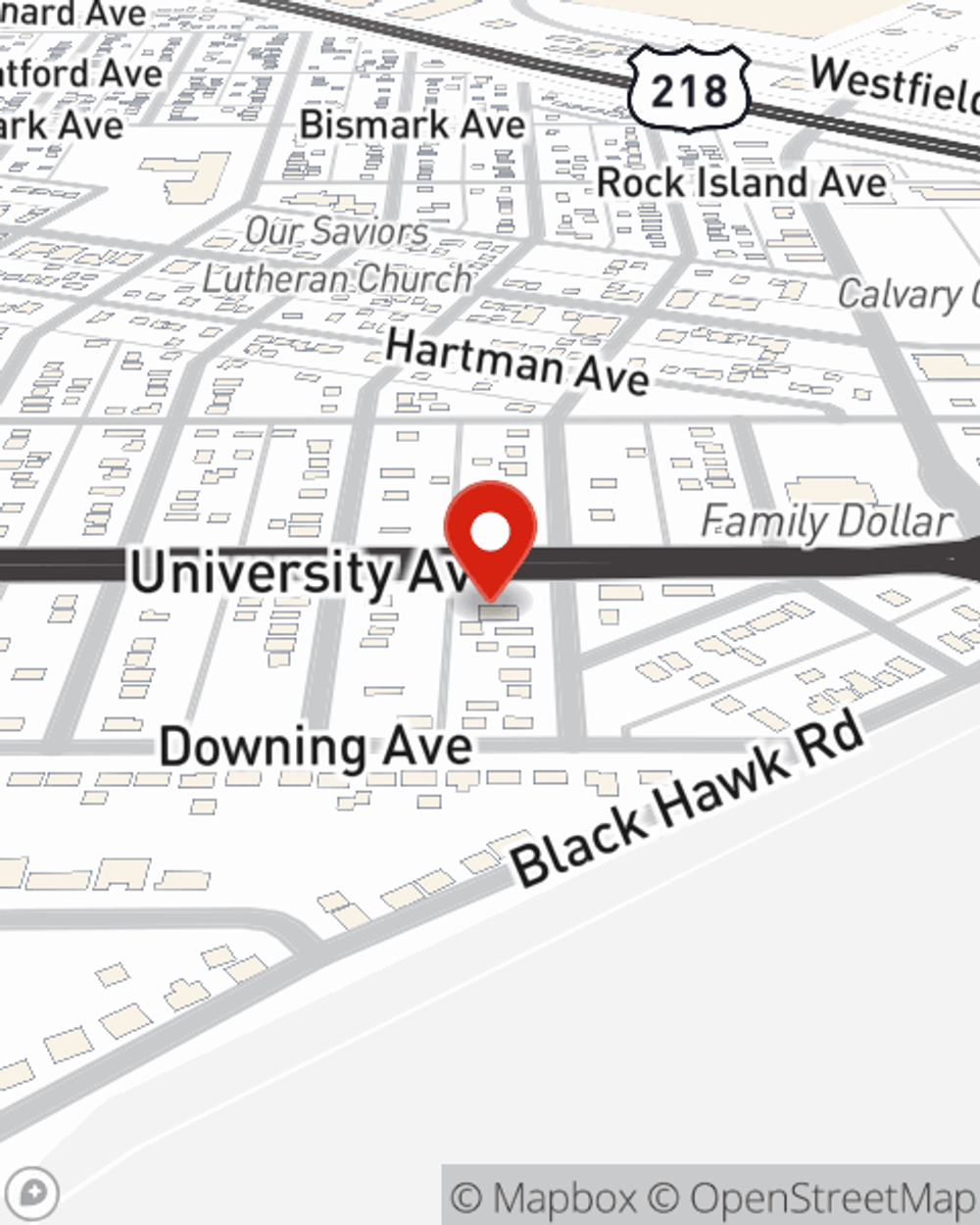

Homeowners Insurance in and around Waterloo

Protect what's important from the unanticipated.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Waterloo

- Cedar Falls

- Dike

- Waverly

- Evansdale

- New Hartford

- Stout

- Hudson

- Jesup

- Independence

- Denver

- Janesville

- Fairbank

- Raymond

- Aplington

- Parkersburg

- Reinbeck

- Elk Run Heights

- Washburn

- Gilbertville

- La Porte City

Home Sweet Home Starts With State Farm

Your home and possessions have monetary value. Your home is more than just a roof and four walls. It’s all the memories you hold dear. Doing what you can to keep your home protected just makes sense! That’s why the most sensible step is to get excellent homeowners insurance from State Farm.

Protect what's important from the unanticipated.

Apply for homeowners insurance with State Farm

Agent Ryan Sullivan, At Your Service

Are you looking for a policy that can help cover both your home and your mementos? State Farm agent Ryan Sullivan's team is happy to help you create a policy that's right for your needs.

Your home is important, but unfortunately, the unanticipated circumstance can happen. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Ryan Sullivan can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Ryan at (319) 236-1099 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.

Ryan Sullivan

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.